It is difficult to choose the right mortgage for your future home with thousands of different options available and each lender having different requirements and rules. We help you find the best mortgage for your budget, unique circumstances and needs and provide expert unbiased advice and guidance.

We will also provide you with different options to make sure you can still afford your monthly mortgage payments in case rates start to increase. The quickest way to discover the maximum you can comfortably borrow is by speaking to an experienced mortgage broker, such as ourselves, and getting them to check out all available mortgage deals, that way you can be sure you get the cheapest deal.

Choosing the right sort of mortgage to meet your needs and circumstances can seem a bit overwhelming. There are many different types to choose from, all meeting the needs of different types of borrowers. The good news is that we’ll be on hand able help you, explaining what’s on offer, what the key features are, and what type of mortgage best meets your individual circumstances.

The first step is to contact us and we will advise you on the mortgage options available to you.

You first need to know what your total available funds are and then subtract the cost of moving home.

We will work with you to check the terms and conditions of your existing mortgage.

Although the perception is that buy to let mortgages are expensive, this isn't necessarily correct.

You buy the share that you can afford, between 50% and 90%, and we cover the rest.

A repayment mortgage is the option that most borrowers opt for, as opposed to interest only.

Most lenders will look at any sound investment to use as a payoff vehicle. Investments are accepted.

The amount of mortgage you can get depends on your income. Some lenders use a multiple of your income others look at how much you can afford based on your income and outgoings. As a rough guide, a typical multiple is four times your income. This figure could be higher or lower depending upon your individual circumstances and different lenders’ criteria. Lenders who look at what you can afford base this on the number of people and any loans or debts that you have outstanding. Some lenders offer very good deals for first time buyers, so it always worth asking us to research the market on your behalf.

It is also worth remembering the additional costs, on top of your deposit and mortgage that you will be expected to pay. For example, you may have to pay stamp duty for the property which you are purchasing. The amount of stamp duty varies depending on the price of the property. Plus you may have to pay for the survey and the valuation of the property, and solicitor’s fees. You may also have fees to pay to the lender for your mortgage. These could be an arrangement fee and/or booking fee. Contact us to find out how much these fees may be.

The amount of mortgage you can get depends on your income. Some lenders use a multiple of your income others look at how much you can afford based on your income and outgoings. As a rough guide, a typical multiple is four times your income. This figure could be higher or lower depending upon your individual circumstances and different lenders’ criteria. Lenders who look at what you can afford base this on the number of people and any loans or debts that you have outstanding. Some lenders offer very good deals for first time buyers, so it always worth asking us to research the market on your behalf.

It is also worth remembering the additional costs, on top of your deposit and mortgage that you will be expected to pay. For example, you may have to pay stamp duty for the property which you are purchasing. The amount of stamp duty varies depending on the price of the property. Plus you may have to pay for the survey and the valuation of the property, and solicitor’s fees. You may also have fees to pay to the lender for your mortgage. These could be an arrangement fee and/or booking fee. Contact us to find out how much these fees may be.

When you’re thinking of selling your existing property and moving to a new home, it’s important that you try and budget accurately. The more accurately you can estimate this figure, the better. To enable you to work out this, you first need to know what your total available funds are and then subtract the cost of moving home. Start by putting some simple figures down on paper, such as:

Then you need to work out the cost of moving house:

The quickest way to discover the maximum you can comfortably borrow is by speaking to an experienced “whole of market” mortgage broker, such as ourselves, and getting them to check out all available mortgage deals, that way you can be sure you get the cheapest deal.

Many of us are looking for a better mortgage deal, or would like to release some of the equity in our home but the process is often not as easy as it first appears. We will work with you to check the terms and conditions of your existing mortgage. These will tell if you are tied-in to your mortgage deal or if there are any early repayment charges. You can then decide if it is worth switching to a different rate or stay put until the penalties have expired. The whole process should take about a month to complete however this may vary from customer to customer. We will of course guide you through the whole remortgaging process, which will include:

Many of us are looking for a better mortgage deal, or would like to release some of the equity in our home but the process is often not as easy as it first appears. We will work with you to check the terms and conditions of your existing mortgage. These will tell if you are tied-in to your mortgage deal or if there are any early repayment charges. You can then decide if it is worth switching to a different rate or stay put until the penalties have expired. The whole process should take about a month to complete however this may vary from customer to customer. We will of course guide you through the whole remortgaging process, which will include:

This can be a popular mortgage option for those wishing to invest in residential rental property. Although the perception is that buy to let mortgages are expensive, this isn’t necessarily correct. There are many lenders who offer competitive rates, which in many cases are generally similar to the rates offered on a standard mortgage.

Landlords also have a choice between interest only and repayment mortgages. Buy to let mortgages do differ in several ways from standard mortgages. When lenders are considering approving a buy to let loan, they generally base their decision on the likely rental income from the property and not necessarily the applicants’ income. A prospective landlord needs to be aware that the rental income typically needed is 125% of the mortgage repayment, although this can vary from as little as 100% rental income up to 130%.

With our expertise in this market, we can help you find the best product to suit your requirements. With our extensive access to thousands of mortgages and our knowledge of lender’s requirements, we can find you the right buy-to-let mortgage.

Buy to Let mortgages are NOT regulated by the Financial Conduct Authority.

Co-Own is our shared ownership plan. In a nutshell, we buy a place together. You buy the share that you can afford, between 50% and 90%, and we cover the rest. You pay the mortgage on your bit and pay us rent on our bit (did we mention that you don’t always need a deposit with Co-Own? Some lenders take our share instead of a deposit). Because the rent we set is lower than the market rate and the mortgage you need is smaller, your monthly repayments could be less than they would be if you’d bought it outright. When you’re able to, you can increase your share in your home bit-by-bit until you own it all. And don’t worry; just because we’ve bought a place together doesn’t mean we’re moving in! It’s 100% your home. If you decide to sell your home and move on, we will value your home. You will get the benefit of any increase in the value of your home due to improvements you have made and then the remaining value will be split between you and us, depending on the share that you own. Since Co-Ownership was founded in 1978, we’ve helped over 29,000 people buy their first home, and we currently have over 9,000 Co-Owners. Could you be our next moving story?

Co-Own is our shared ownership plan. In a nutshell, we buy a place together. You buy the share that you can afford, between 50% and 90%, and we cover the rest. You pay the mortgage on your bit and pay us rent on our bit (did we mention that you don’t always need a deposit with Co-Own? Some lenders take our share instead of a deposit). Because the rent we set is lower than the market rate and the mortgage you need is smaller, your monthly repayments could be less than they would be if you’d bought it outright. When you’re able to, you can increase your share in your home bit-by-bit until you own it all. And don’t worry; just because we’ve bought a place together doesn’t mean we’re moving in! It’s 100% your home. If you decide to sell your home and move on, we will value your home. You will get the benefit of any increase in the value of your home due to improvements you have made and then the remaining value will be split between you and us, depending on the share that you own. Since Co-Ownership was founded in 1978, we’ve helped over 29,000 people buy their first home, and we currently have over 9,000 Co-Owners. Could you be our next moving story?

A repayment mortgage is the option that most borrowers opt for, as opposed to interest only.

With a repayment mortgage, or capital repayment loan to give it its full name, you pay back both the capital and interest until the mortgage is paid off. This way you guarantee that the mortgage will be paid at the end of the term.

You make monthly payments for an agreed time period, which is normally twenty five years. Depending on your circumstances this could be up to forty years or age seventy five.

As a mortgage is secured against your home, it could be repossessed if you do not keep up the mortgage repayments.

With an interest only mortgage, you only pay the interest on the loan each month, which means that the capital sum stays the same throughout the period of the mortgage. You don’t repay any of the capital until the end of the loan time period.

This means that you need to make preparations for paying off the capital sum at the end of the term.

Interest only mortgages aren’t as broadly used as they once were. However, most lenders will look at any sound investment to use as a payoff vehicle. Investments like pensions or ISAs can be accepted.

As a mortgage is secured against your home, it could be repossessed if you do not keep up the mortgage repayments.

With an interest only mortgage, you only pay the interest on the loan each month, which means that the capital sum stays the same throughout the period of the mortgage. You don’t repay any of the capital until the end of the loan time period.

This means that you need to make preparations for paying off the capital sum at the end of the term.

Interest only mortgages aren’t as broadly used as they once were. However, most lenders will look at any sound investment to use as a payoff vehicle. Investments like pensions or ISAs can be accepted.

As a mortgage is secured against your home, it could be repossessed if you do not keep up the mortgage repayments.

For more information about any of our services, please contact us and a member of our team will be in touch shortly.

Term insurance comes in several forms. There is level term which has a guaranteed sum assured and a guaranteed premium. It will run for a finite time which could be anything from one year to fifty years. This is the simplest form of life insurance and the one used in most cases.

It means if you die it will pay out to your chosen beneficiary the sum assured you have chosen at outset. This can be written, like most policies, in Trust to avoid Inheritance tax. That is a subject on its own.

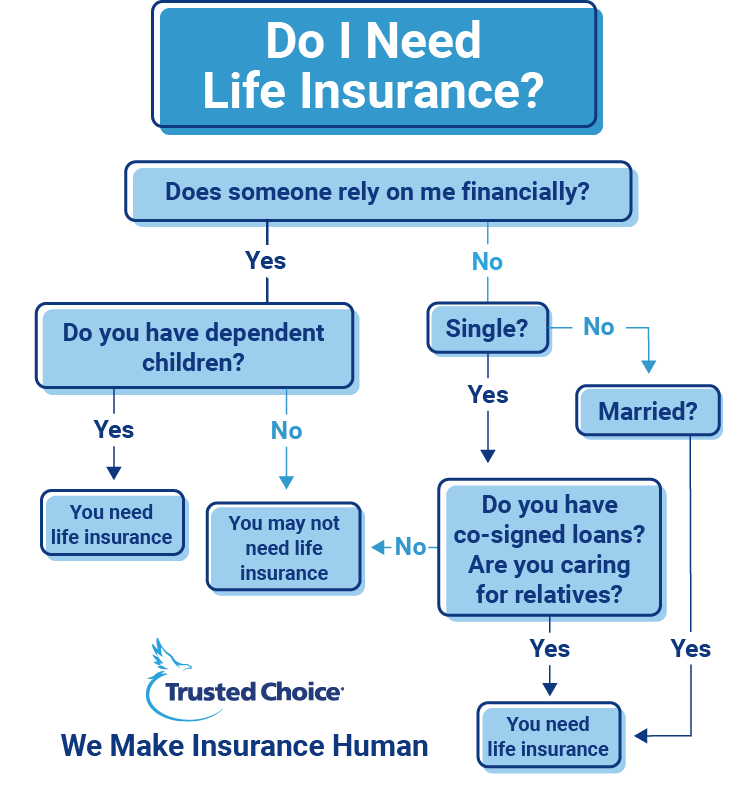

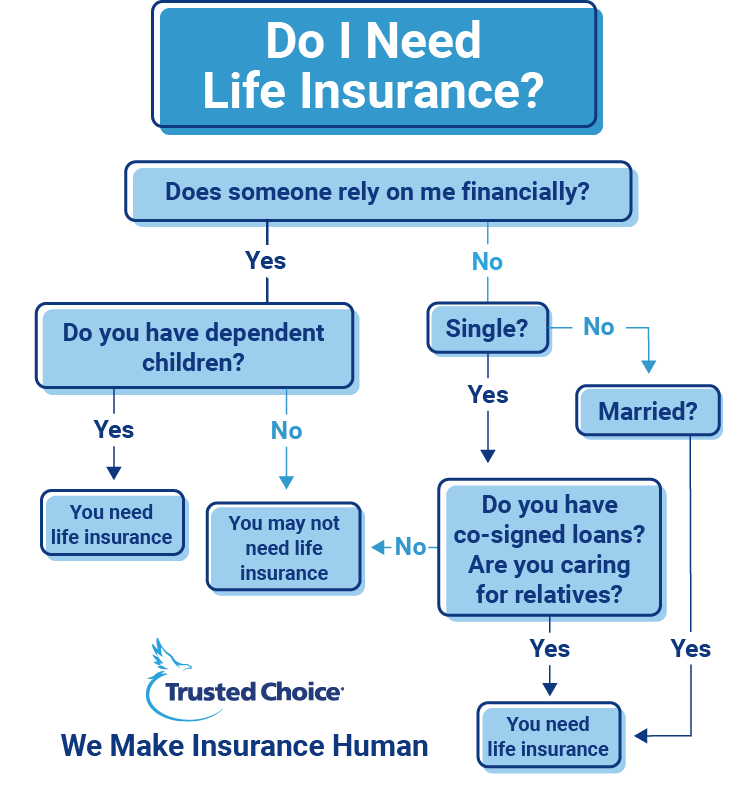

The question you must ask yourself before you take out life insurance is, would anyone suffer financially if I were to die? If the answer is yes. Then you need life insurance.

The question is how much? And which type. Well, you would ideally need enough of a lump sum to be invested at 5% return to equal an income to replace your net income. In other words leave your family financially in the same position as they were before your death.

In the calculation you would deduct any employer death in service benefits and any pension that may be paid to your beneficiary. You would also deduct the mortgage amount as it should ideally be covered under a separate mortgage decreasing term policy. As life insurance brokers we have our own software which works these figures out for you. It takes the guesswork out of the equation.

Term insurance comes in several forms. There is level term which has a guaranteed sum assured and a guaranteed premium. It will run for a finite time which could be anything from one year to fifty years. This is the simplest form of life insurance and the one used in most cases.

It means if you die it will pay out to your chosen beneficiary the sum assured you have chosen at outset. This can be written, like most policies, in Trust to avoid Inheritance tax. That is a subject on its own.

The question you must ask yourself before you take out life insurance is, would anyone suffer financially if I were to die? If the answer is yes. Then you need life insurance.

The question is how much? And which type. Well, you would ideally need enough of a lump sum to be invested at 5% return to equal an income to replace your net income. In other words leave your family financially in the same position as they were before your death.

In the calculation you would deduct any employer death in service benefits and any pension that may be paid to your beneficiary. You would also deduct the mortgage amount as it should ideally be covered under a separate mortgage decreasing term policy. As life insurance brokers we have our own software which works these figures out for you. It takes the guesswork out of the equation.

Mortgage life insurance is term insurance that decreases every year to keep pace with the mortgage that you owe. It will pay out the amount you owe on your mortgage at any time during the term. Although the sum assured is decreasing each year, the premium remains level throughout the term. This type of insurance is probably the cheapest to buy because the risk to the insurance company reduces each year. As in any type of term policy there is no investment content so no cash return. If your mortgage is on an interest only basis you should elect to take out level term.

Even within these types of policy there are add-ons for example:

To my mind the most important of the range of insurance protection products. Let’s face it if you are of work sick and you are on Statutory Sick Pay (currently £83 per week), everything else fails. The mortgage doesn’t get paid, the car payments fail and the fact is you are in financial trouble. Income Protection pays out a monthly payment of up to sixty five percent of your gross pay. This payment is currently tax free. You can defer your claim from one day to one year. It depends on how long you can do without your income. You may have savings or your employer may pay you for six month or even one year. That is when you would want the policy to kick in.

It doesn’t matter how many claims you have or if you are off work with an illness you had previously claimed for you will be covered. This differs from critical illness as you could well be off work because of an accident which critical illness would not cover.

This type of policy normally runs to your retirement or you cease work. Again there is no investment value so no return. You can link your sum assured to inflation so that the pay-out will increase over the years with your income. This is probably the most undersold policy in the market.

To my mind the most important of the range of insurance protection products. Let’s face it if you are of work sick and you are on Statutory Sick Pay (currently £83 per week), everything else fails. The mortgage doesn’t get paid, the car payments fail and the fact is you are in financial trouble. Income Protection pays out a monthly payment of up to sixty five percent of your gross pay. This payment is currently tax free. You can defer your claim from one day to one year. It depends on how long you can do without your income. You may have savings or your employer may pay you for six month or even one year. That is when you would want the policy to kick in.

It doesn’t matter how many claims you have or if you are off work with an illness you had previously claimed for you will be covered. This differs from critical illness as you could well be off work because of an accident which critical illness would not cover.

This type of policy normally runs to your retirement or you cease work. Again there is no investment value so no return. You can link your sum assured to inflation so that the pay-out will increase over the years with your income. This is probably the most undersold policy in the market.

Unlike term insurance Whole of Live insurance does not have a defined term. It will run until the insured dies. This type of policy has fallen out of favour in recent years because of the steep increase in premiums at five and ten year anniversaries where the actuary will determine the premium for the next period. It is still useful however in mitigating inheritance tax as it is geared to run until the assured dies.

It is written in trust by the settlor to avoid tax and the sum assured is paid to the beneficiary through the trust which in turn is used to pay the IHT bill to the HMRC.

All of these policies are complicated in their own right and it is imperative that the right one is chosen as the wrong one can do more damage financially than good.

Financial Advisers are trained and qualified to give you the best advice on this very important subject and you would be well advised to take professional advice before you proceed.